Roofing Damage Insurance: What Arizona Homeowners Need to Know

Roofing Damage Insurance: What Arizona Homeowners Need to Know

For Arizona homeowners, understanding how roofing damage insurance works can be the difference between paying thousands out of pocket and getting a full roof replacement covered by your policy. At Castile Roofing, we’ve helped hundreds of Valley residents—from Avondale to Peoria to Mesa—navigate the complex process of insurance-funded roofing repairs.

The reality is this: most homeowners don’t fully understand how their roofing damage insurance coverage works until disaster strikes. Whether it’s a monsoon that tears shingles from your roof in Goodyear or a surprise hailstorm that leaves deep granule loss across a property in Glendale, your ability to act fast and correctly file a claim can dramatically impact the outcome.

Our team has over 14 years of experience working directly with insurance carriers. We know what they’re looking for, how they evaluate damage, and—most importantly—when they’ll approve full replacement versus limited repair. From filing support to adjuster meetings and photographic documentation, Castile Roofing is your advocate in the process.

To get help with your own roofing insurance situation, start by visiting our Contact Us page. Or, learn more about who we are and our service philosophy on the About Us page.

According to the Insurance Information Institute, wind and hail are the most frequent causes of homeowner insurance claims—and roof damage is the most common reason people file them. Unfortunately, many claims are denied or underpaid because homeowners wait too long, lack documentation, or work with roofers unfamiliar with the claims process.

That’s where Castile Roofing stands apart.

We don’t just repair roofs—we help homeowners through every phase of the roofing damage insurance process. And we do it across the entire Phoenix metro area, including cities like Tempe, Tolleson, Anthem, Cave Creek, and Avondale.

When Does Roofing Damage Insurance Cover Repair vs. Replacement?

One of the most misunderstood aspects of roofing damage insurance is the line between repair and full replacement. Insurance companies don’t always make that distinction clear—until you’ve already filed a claim. At Castile Roofing, we help you understand the factors adjusters consider so you can prepare accordingly.

So, when will your roofing damage insurance cover a few missing shingles, and when will it pay for an entirely new roof?

It Comes Down to Two Things:

-

Extent of the Damage

-

Whether Materials Can Be Matched

Let’s break that down.

1. Extent of the Damage

If your roof sustained damage to a single slope or a few shingles, and the rest of the roof is structurally sound, most insurance companies will offer to pay for localized roofing damage insurance repair.

However, if multiple areas of your roof were affected—or if the damage threatens the overall integrity of the roof—then insurance may approve a full roof replacement. This is especially common after major events like:

-

Monsoon windstorms that tear off shingles across several elevations

-

Hailstorms that cause widespread granule loss

-

Debris impacts during high-wind events

-

Flashing failure that leads to water intrusion

The National Weather Service highlights how severe thunderstorm events—common in Arizona’s summer monsoon season—frequently result in damaging winds exceeding 58 mph. This is more than enough to tear shingles, loosen flashing, or expose underlayment.

2. Color and Material Match

This is one of the most important—and often overlooked—factors that determine whether your roofing damage insurance claim will be repair or replacement.

If your shingles are older, discontinued, or significantly weathered, it may be impossible to find an exact match for repairs. When mismatched shingles would reduce your home’s curb appeal, violate HOA standards, or affect resale value, insurers often agree to cover a full roof replacement—even if only part of the roof is technically damaged.

This precedent is based on something called “matching state statutes” or cosmetic coverage clauses in your homeowners insurance policy. Arizona doesn’t require matching coverage by law, but many insurers choose to offer it voluntarily—especially for visible damage.

Castile Roofing has helped hundreds of homeowners across Mesa, Glendale, and Surprise get full roof replacements due to unmatched shingle color alone. We know how to document the color mismatch, provide manufacturer documentation, and advocate during adjuster walkthroughs.

If you’re unsure whether your damage qualifies, explore your full-service options on our roofing installation Avondale page or contact us directly for a no-obligation inspection.

Understanding the Roofing Damage Insurance Claims Process Step by Step

Filing a roofing damage insurance claim may feel intimidating—but it doesn’t have to be. At Castile Roofing, we walk homeowners through every phase of the process, from initial inspection to final repair. If your roof has been impacted by hail, high winds, or storm debris, acting quickly and following the right steps can significantly increase your chances of full coverage.

Here’s how the typical roofing damage insurance process works in Arizona:

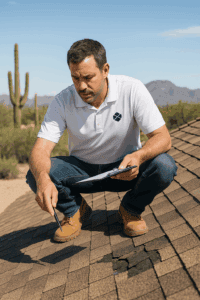

Step 1: Schedule a Professional Inspection

Before calling your insurer, you need a professional evaluation. At Castile Roofing, we inspect your roof for wind-lifted shingles, granule loss, cracked flashing, water intrusion, and impact marks from hail or falling branches. We photograph everything and prepare a report that supports your potential claim.

This is especially important for homes in monsoon-prone areas like Avondale, Buckeye, or Cave Creek, where storm damage can be extensive but not always immediately visible.

Step 2: File the Insurance Claim

After our inspection, you file the claim with your homeowners insurance provider. You’ll typically receive a claim number and be assigned a field adjuster who will inspect your roof.

We recommend that your contractor—like Castile Roofing—be present during the adjuster’s visit to ensure that all damage is documented properly. We often identify areas that adjusters miss, especially subtle granule loss or non-obvious water entry points.

Step 3: Meet with the Adjuster

We attend the adjuster meeting to ensure that the insurance company is aware of exactly what your roof needs. Our team speaks the language of insurers and understands how roofing damage insurance claims are evaluated. We provide evidence, product data, and repair vs. replacement justifications that support a fair payout.

We’ve helped clients in Tempe and Glendale receive full roof replacements instead of limited repairs by demonstrating color mismatch, manufacturer discontinuation, and structural concerns.

Step 4: Claim Approval and Payout

Once the adjuster files their report, your insurance company will determine the payout. If your policy includes Replacement Cost Value (RCV), your insurer may pay in two installments: the actual cash value up front, and the remainder after work is completed and invoiced.

According to the Consumer Financial Protection Bureau, working with licensed, local contractors is one of the best ways to avoid delays and ensure you receive the full value of your roofing damage insurance claim.

Step 5: Repairs or Full Roof Replacement

Once approved, Castile Roofing gets to work—often within a few days. We perform either targeted roofing damage insurance repairs or complete tear-off and re-roofing projects using GAF-certified materials or premium-grade tile, depending on your home and policy.

Visit our roofers in Peoria or roofers in Tempe pages to see examples of projects we’ve completed across the Valley.

What Affects Your Roofing Damage Insurance Coverage?

Not all insurance policies are created equal. If you’re counting on your roofing damage insurance to cover storm repairs or a full replacement, it’s important to understand what’s actually included—and what might be excluded. Many Arizona homeowners don’t realize the fine print of their policies until after a storm hits and the adjuster comes knocking.

At Castile Roofing, we help you interpret your policy and understand your rights before filing a claim. Here’s what affects whether your roofing damage insurance pays for repair, replacement, or nothing at all.

1. Policy Type: RCV vs. ACV

Most homeowners policies offer one of two coverage types:

-

Replacement Cost Value (RCV): Pays for full replacement cost of your roof (minus deductible), regardless of depreciation. This is ideal.

-

Actual Cash Value (ACV): Pays for the depreciated value of your roof. If your roof is 15+ years old, this may be far less than replacement cost.

If your policy only pays ACV, your out-of-pocket expenses may be significantly higher—even if the insurer approves the claim. Always check your declarations page or ask your agent to confirm.

According to the National Association of Insurance Commissioners (NAIC), many insurers are transitioning older homes to ACV policies unless homeowners specifically request RCV.

2. Exclusions and Maintenance Clauses

Most roofing damage insurance policies cover sudden, accidental damage—like wind, hail, or falling trees. But they usually exclude:

-

Damage due to normal aging or wear and tear

-

Leaks caused by lack of maintenance

-

Damage from prior repairs done improperly

-

Mold or interior damage not promptly reported

That’s why it’s essential to act quickly after a storm. A leak today could be denied tomorrow if the insurer decides you waited too long to file.

Castile Roofing helps clients in Phoenix, Sun City, and Buckeye avoid these exclusions by inspecting and documenting damage immediately. We also help homeowners prove the damage is storm-related—not due to neglect—by showing patterns consistent with wind uplift or hail impact.

3. Matching Coverage and Cosmetic Damage

As mentioned earlier, some roofing damage insurance policies will cover full replacement if matching shingles are no longer available—even if the damage is limited to a single slope. Others only cover repairs to the affected area.

Policies with matching coverage or cosmetic damage clauses are more likely to cover full replacement in the case of shingle discontinuation or visible mismatch.

We help document and validate mismatch claims using shingle manufacturer data, color matching tools, and comparison photos. If you’re located in a neighborhood governed by an HOA—like many subdivisions in Goodyear or Peoria—your roofing damage insurance may also cover full replacement to stay compliant with appearance standards.

For more information about how we handle full system upgrades, visit our roofing installation Avondale page.

Why Roofing Damage Insurance Claims Get Denied — and How to Avoid It

Filing a roofing damage insurance claim doesn’t always guarantee a payout. In fact, thousands of claims across Arizona are denied each year due to technicalities, lack of documentation, or missed deadlines. At Castile Roofing, we’ve seen it all—and we’ve helped many clients in cities like Mesa, Avondale, and Surprise turn denials into approvals through expert support and second inspections.

Here are the most common reasons roofing damage insurance claims get denied—and how we help you avoid them.

1. Delayed Filing

Most insurers require that homeowners report damage within a specific window—often 30 to 60 days from the event. If you wait too long to file after a storm, your provider may claim that the damage is due to aging or lack of maintenance, not a covered event.

Our solution: We provide same-day inspections after major weather events and document the exact date and time damage was discovered.

2. Insufficient Documentation

Photos of missing shingles are rarely enough. Insurance companies want to see underlayment exposure, hail hits, flashing damage, and water penetration.

Our solution: Castile Roofing delivers full inspection reports with time-stamped photos, slope-by-slope analysis, and weather data from trusted meteorological sources like NOAA.

3. Pre-Existing Conditions

If your roof was already in poor shape, your insurer may argue the damage isn’t storm-related. This is common for roofs over 20 years old or those with visible deterioration.

Our solution: We isolate storm-related damage from pre-existing wear using detailed photos and structural tests. We’ve successfully overturned denial decisions in cities like Queen Creek and Tonopah by proving that the cause was recent weather, not general aging.

4. Cosmetic-Only Damage

Some providers claim that visible damage doesn’t compromise the function of your roof and therefore doesn’t qualify. This is especially common with granule loss or mismatched replacement shingles.

Our solution: We document how “cosmetic” issues reduce the resale value of your home, violate HOA standards, and increase the risk of future failure. In some cases, we submit statements from real estate professionals or appraisers to support full replacement under roofing damage insurance coverage.

5. No Contractor Present at Adjuster Inspection

This is one of the biggest missed opportunities. If you don’t have a qualified roofing contractor onsite during the adjuster visit, they may overlook or underestimate the scope of damage.

Our solution: Castile Roofing always attends the adjuster meeting to ensure nothing is missed. We advocate for your claim, not the insurance company’s bottom line.

If you’re in a situation where your roofing damage insurance claim was denied or undervalued, don’t give up. Contact us right away through our Contact Us page. We can provide second opinions, re-inspections, and even support supplemental claims backed by fresh evidence.

Navigating Insurance for Shingle Roofing Repair

Have roof damage after a storm or high winds? If you’re wondering whether your shingle roofing repair might be covered by insurance, you’re not alone. Many Arizona homeowners don’t realize that wind, hail, and monsoon damage often qualifies for repair—or even full replacement—under their homeowners insurance policy.

If shingles have blown off your roof or you’ve noticed sudden leaking after a storm, we’ll inspect the damage, document everything thoroughly, and guide you through the claims process.

Here’s how it works:

-

Roof Inspection – We perform a full inspection and take detailed photos.

-

Filing the Claim – You report the damage to your insurance provider.

-

Adjuster Appointment – We meet with the adjuster to advocate for proper repair or replacement.

-

Approval – The insurer determines whether to pay for shingle roofing repair or a full roof replacement.

-

We Complete the Work – Once the claim is approved, we move forward quickly with professional repairs or re-roofing.

In many cases, if the damaged shingles cannot be matched in color or style due to manufacturer discontinuation, insurance companies will authorize a full roof replacement instead of a partial shingle roofing repair. This is because patching with mismatched materials can reduce your home’s value and violate HOA or resale standards.

Our team knows what adjusters look for, how to prove color mismatch, and how to build a solid case for full coverage when appropriate. Whether you live in Goodyear, Peoria, or Avondale, we’ve helped hundreds of Valley homeowners receive full roof replacements through well-documented storm damage claims.

If you think you might qualify, don’t wait. Schedule a free inspection through our Contact Us page and let us take the guesswork out of the shingle roofing repair insurance process.

Why Castile Roofing Is Arizona’s Leader in Shingle Roofing Repair

When it comes to choosing a contractor for shingle roofing repair, trust and local experience matter. Castile Roofing has been serving the Phoenix metro area for over 14 years, delivering honest estimates, professional workmanship, and long-lasting results. We’ve built our reputation one roof at a time, helping homeowners in Avondale, Glendale, Tempe, Mesa, Buckeye, and beyond protect their homes with precision repair work.

Here’s what sets us apart:

-

Locally Owned and Operated – We’re not a national chain or pop-up storm chaser. We’re based right here in Arizona and proud to serve our neighbors.

-

ROC Licensed Crews – Every shingle roofing repair is performed by a licensed, trained team—not subcontractors or temporary hires.

-

Professional Leadership – Our CEO is a Stanford MBA graduate, and our company is run with integrity, efficiency, and accountability.

-

Clear Communication – We explain every step of your repair, provide photos, and follow up to ensure long-term satisfaction.

-

Top Reviews – We’ve earned hundreds of 5-star reviews across Google and other platforms thanks to our attention to detail and commitment to quality.

Whether you’re dealing with curling shingles in Queen Creek, storm damage in Goodyear, or old age and sun exposure in Cave Creek, we bring the same level of professionalism to every job. Our shingle roofing repair services aren’t just about fixing a roof—they’re about protecting the value of your home, your peace of mind, and your family’s safety.

We also provide maintenance advice and regular inspections for homeowners who want to stay ahead of future issues. In many cases, we catch and repair damage before it becomes a costly replacement. And when replacement does become necessary, we make the transition seamless—see our roofing installation Avondale page for more info.

To learn more, visit our About Us page or Contact Us to book your free inspection today. If you need shingle roofing repair, Castile Roofing is the team Arizona trusts.